Coinhub | How to play with the NFT collections?

Coinhub | How to play with the NFT collections?

Coinhub official website: https://www.coinhub.org/

Coinhub Download link: https://www.coinhub.org/download

NFT is in full swing. In addition to the GameFi track Axie leading the crowd, 10000 monkeys at the NFT Collection track-boring Apes Yacht Club Bored Ape Yacht Club (hereinafter referred to as BAYC) have led a new round of investment craze in the NFT collection. More specifically, it can be a “avatar” craze. It may be mentioned here that your first reaction is the leading eldest brother CryptoPunks. It is true that the hegemonic position of CryptoPunks naturally does not need to be introduced again. It set a precedent of value just like the status of BTC on the NFT track.

The rise of BAYC made the market see new possibilities (just as the rise of ETH led to all kinds of public chain imitations). Then after BAYC, all kinds of animal portraits NFT sprang up like bamboo shoots after a spring rain and grew savagely, which was no less than the animal coin craze of MEME in the first half of the year, and even much higher than the animal coin craze, because this NFT craze was no longer Musk’s desperate call, and celebrities from all walks of life KOL entered the game one after another. Push the whole market to another level of the best part, of course, look at the market rationally and objectively, in fact, the composition of the bubble is very large, discrete liquidity, weak value support, the hot summer of NFT is also jokingly called JPEG Summer by many people.

Of course, no matter whether it is a bubble or not, from the perspective of asset appreciation, things with wealth effect are worth participating in. Under such an upsurge, let’s discuss how to scientifically enter the NFT Collection (JPEG).

The course of the rise of BAYC

I. background of birth

On April 30, 2021, BTC surged to about $55000, and the whole market was waiting for the pie to continue to rise in FOMO. BAYC was born. The picture depicted in the background of BAYC’s story is also in line with the psychological expectations of investors in the bull market at that time. The background of the story is probably as follows: every ape devoted to encryption has become a billionaire ten years later, and life after financial freedom has become boring. So set up a boring ape yacht club, get together in a small bar, play graffiti, walk the dog, and live a boring “lying flat” life.

Now it seems that the setting of BAYC’s story is also very suited to the taste of the market, or hit the weakness of human nature. After all, everyone in the bull market is wandering in the pleasant atmosphere of lying down to make money. If the background described is that the apes who worked in the field of encryption ended up with nothing or mediocrity, or set the background as an independent concept of sci-fi IP, then I don’t think he can be quickly accepted by the market.

II. Innovation

Not only works of art, but also digital identities:

10,000 NFT unified pricing 0.08ETH, using first-come-first-served seigniorage (Mint), and each NFT holder, not only obtained the “work of art”, but also the club membership card, is a digital identity, club members have including airdrop, access to the surrounding and other membership rights.

Open copyright

The project party authorizes the copyright and use rights of all NFT to the holder (except BAYC Logo), that is, as long as he holds an ape NFT, he can carry out secondary creation, derivative production, and even various commercial uses based on the ape.

III. Rise

KOL effect

On May 1, 2021, shortly after BAYC went on sale, famous NFT art collectors J1mmy and Pranksy tweeted that they bought 100,250 apes respectively.

Within 12 hours of the launch of the BAYC, all 10000 apes were sold out, with a total revenue of 800ETH, which was about $2.2 million at the time of ETH.

BAYC issued an announcement on May 29th, 2021, announcing the distribution of exclusive limited edition to all NFT holders, including 150 black baseball caps, 60 red baseball caps, 150 long-sleeved T-shirts and 150 short-sleeved T-shirts. Member prices are very low. 510 items sold out in 6 minutes, while the price of transfer to the secondary market soared to thousands to tens of thousands of dollars.

Community promotion-a symbol of identity

Between May and June 2021, the BAYC community launched an Ape Follow Ape campaign (apes follow apes), in which BAYC holders follow and support each other as if they were relatives after changing ape avatars on social media such as Twitter, Discord and Clubhouse. For a long time since then, there has been a huge trend of “ape avatar” on social media such as Twitter, and BAYC has taken its identity to the extreme.

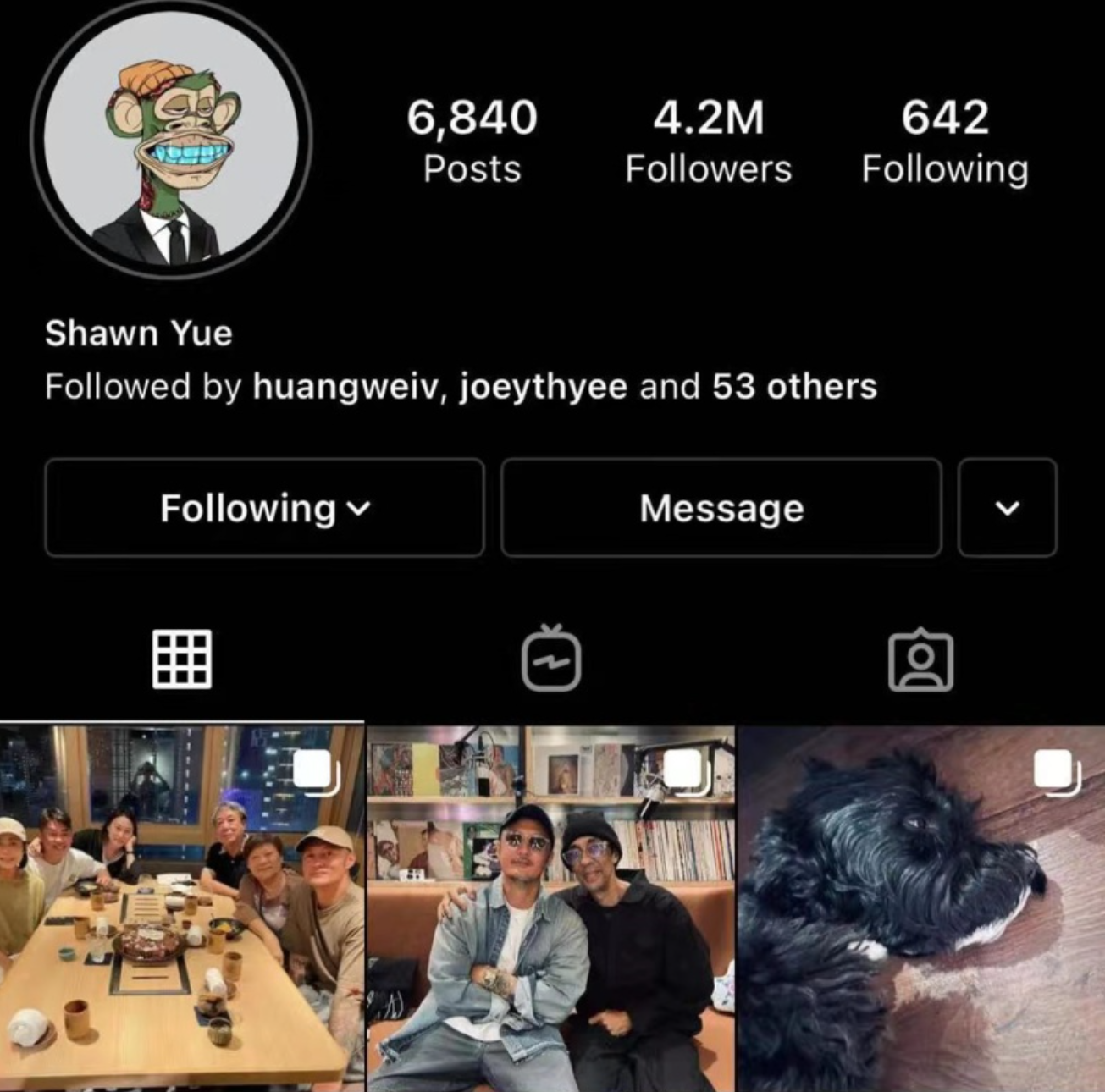

This round of events attracted celebrities from all walks of life to buy BAYC and replace their social media avatars. According to incomplete statistics, celebrities from all walks of life who have publicly announced BAYC holders include Taiwanese singer Maji Big Brother Huang Licheng, actors Wu Jianhao and Chen Bolin, Hong Kong movie star Yu Wenle, NBA star Pelicans shooting guard Josh Hart, Hornets star LaMelo Ball, NFL American Football League star Franklin and so on. And in the encrypted currency circle to buy BAYC of the major well-known KOL is too numerous to list.

Also between May and June, BAYC has long been at the top of NFT24 hourly trading volume rankings. Beat CryptoPunks, NBA Top Shot, Meebits and other established projects

On June 19, 2021, BAYC officially announced that it would airdrop a NFT in the form of a pet dog to each ape owner. Affected by this positive effect, the price of apes in the secondary market has risen rapidly. According to Opensea data on NFT trading market, the price of ape floor has broken through 2ETH on that day, while even the lowest price of airdropped pet dogs is as high as 0.6ETH, and the number of addresses holding BAYC has climbed to 4300 +. It can also be seen from the market trading data that the explosive growth of the NFT market was also at the end of June.

The Chinese ape community, called BAMC, set up the Monkey Fund in May and raised 106Eth to buy BAYC with rare attributes. It is understood that now this fund has been worth 3200+ETH, “Huaguo Mountain” has also become a more influential Chinese NFT community.

Wealth effect + IP cultural creation asset fermentation

Cryptopunks single highest transaction price 4200ETH, NBA Top Shot a LeBron James NFT card sold for 100000 US dollars, Beeple a painting sold for 69 million US dollars, all these benefit myths attracted the attention of capital, BAYC naturally became the target of speculation, the further fermentation of its IP, secondary creation and derivatives based on BAYC sprang up like bamboo shoots after a spring rain. NFT works: children’s apes, ape records, ape yachts, ape councils, ape cartoons, ape novels, etc. Physical products: masks, drinks, clothing, skateboards and so on.

From the perspective of artistic aesthetics, the image design of BAYC does have a strong trend element and tide brand culture, which is also the hot track in the traditional industry in the past two years. It is not difficult to see that BAYC has enough potential to develop into a top trend brand in the world. The copyright open to holders of BAYC is of great significance to this trend, just like open source software, attracting a large number of creators to carry out secondary creation and derivatives production on the basis of apes, which has brought about an exponential growth in users and traffic.

The promotion of multi-resources continues to attract new entrants, and the floor price of BAYC has soared to 24.99ETH as of the time of writing.

Endorsement by top institutions

On Aug. 6, 2021, Christie’s officially announced that it would launch the NFT auction on Sept. 17, targeting Cryptopunks, BAYC and Meebits. At that time, the price of BAYC floor had risen to 15ETH and the price of ape pet floor reached 2.8ETH.

Summary

From the above, we can see that the success of BAYC can be summarized as follows: IP fundamentals, community effect, KOL effect, media popularity, institutional blessing.

The reason why I spend so much time talking about BAYC is that I hope you can work with me to refine and comprehend the key points in its development process. These experiences are also the auxiliary basis for us to make investment decisions on NFT collectibles.

In fact, when evaluating a new project, the nature of the evaluation method is similar to that of other DeFi projects, which is divided into the following points:

1) Analysis of NFT fundamentals:

Story background (relevance to the current mainstream), long-term operation roadmap, as well as NFT application scenarios, and copyright expandable space

2) Market / community heat:

Media fans and activity (Twitter, TG, Discord), ranking in each big data website, rarity index (Rarity view)

It is difficult to directly quantify the number and volume of the community, as well as the activity within the community, as well as whether the community has a strong ability to promote operations. It is still necessary to join the community to see for themselves the value identity of the community members to the project, and whether the community can continue to export the value of NFT. In the decentralized market, the role of the community is more like the public relations facade of the project, and the community is strong enough. In order to keep pushing up the popularity of the project.

3) KOL indicators:

Industry Big V recommendation, you can directly search for relevant tweets in Twitter and Weibo, as well as search keywords in, Yotube and bilibili to see if there is any content related to the output of industry Big V.

Artist co-signature: the effect of artist co-naming is the same as that of traditional fashion brands, such as shoes sold jointly by NIKE&DIOR, which are directly speculated to more than five times the price in the secondary market.

Celebrity purchase support. If a star buys the NFT, the news will generally spread widely, which can be seen in its official group. At the same time, you can also follow the social media of some stars who have bought other NFT, or you can find their address more directly. For example, Xu Jinglei’s address was revealed some time ago.

4) participation of giant whales:

Whether there are any active large players participating in the project, you can check whether the positions of large NFT players are covered through NFT GO,NANSEN.

5) team background and institutional participation

Check the background and resources of the founding team members of NFT through official information, whether there is capital participation in investment, or support from large institutions.

In essence, the reference index for evaluating a NFT collection project is similar to that for evaluating a DeFi project, but the value weight of the IKOL index is relatively higher in the NFT field. The most important value of the current NFT collection lies in its social value, that is, to highlight personal identity tags, just like a limited edition of AJ or a limited edition of Herm è s, the potential brought by celebrity intervention can not be underestimated.

Investment Strategy of NFT Collectibles

Value depression

Invest in ziNFT collectibles, more in zi’s brand IP value.

Different from the Token in the conventional secondary market, the liquidity of NFT collectibles is usually low, and at present, the unit price is generally high and the capital efficiency is relatively low. It is understandable to buy from the perspective of collection, but from the point of view of investing in zi, it is mainly discussed to start with value depressions, that is, only copying the floor price of NFT collectibles IP, the value growth of a single IP series NFT has a strong joint effect, which is essentially the increase of the value of its brand. Therefore, when entering the NFT unit, you can earn the benefits brought by the appreciation of its IP by directly starting with the floor price NFT under its IP.

Eggs can not be put in one basket, and it is the same here. At the same time, we can copy the floor price of several NFT projects to improve capital efficiency and balance risks to a certain extent. Buy at least 2 NFT products with floor prices, and set the profit stop point according to a conservative strategy. For example, for a relatively hot NFT, the price doubles the principal to ensure that the U standard is intact, leaving profits to roll over at will, which can also help us HODL and capture its long-term value. This process is like an angel investing in zi.

NFT fragmentation

Simply holding NFT, in addition to looking at it every day and changing into social media avatars, there is only collection left, which seems to be meaningless. At this time, there is a way to play NFT+DeFi-NFT fragmentation.

The essence of fragmentation is NFT securitization, which divides a NFT into multiple ERC20 tokens, the fragmented tokens are the certificate tokens of NFT value, and the future generations are split into homogenized tokens, just like the token we bought in the secondary market. The benefits of NFT fragmentation are as follows:

Low threshold for participation

The mainstream NFT collectibles often have dozens of ETH prices, which is not friendly to ordinary retail investors. The risk is extremely high to turn the one-off MINT of the position ETH into a low-liquidity NFT. After all, the value dimension of the NFT collection is relatively simple, far less than the Token value of the conventional DeFi agreement, and there is no competitive advantage in the economic model. More is its IP cultural value.

For participants, after fragmentation, they can use less money to buy the certificate of fragmented token, capture the increase of its value, realize profit, greatly reduce the threshold of participation, and at the same time, it is more conducive to the transmission of IP value of NFT. Just like when people invest in zi gold, they don’t need to buy the physical object of gold directly, they only need to buy the securitized tokens of gold.

High capital efficiency

For holders, holders can use fragmented permits to participate in DeFi loans, and the principal borrowed can participate in more project agreements, which greatly improves the liquidity of funds, is not limited to the indivisible attribute of NFT, and maximizes capital efficiency.

At the same time, holders can also use their permits to create 1DO and create LP in UNI (which are also the two main ways for other users to buy fragmented permits). This is equivalent to the issuance of a new market by NFT holders, in which holders can be regarded as market makers, on the one hand, providing lower entry barriers for more users. On the other hand, it can also directly promote the price growth through personal control, that is, the value growth of NFT itself. If multiple NFT holders choose this strategy, it will further promote the IP value growth of NFT, thus driving the soaring price of individual NFT under its series, which is also an important driving force for the current mainstream NFT series assets to continue to rise.

Fragmented pass is not suitable for all NFT collections, generally with high market value and relatively stable price of NFT, if it is a new NFT project, its value has not been recognized by the market, the significance of fragmentation is naturally meaningless.

Fragmented play can be said to give a very high value to the NFT market and maximize the capital efficiency of the holders, but there are also certain risks for the holders, such as the liquidation of loans using fragmented pass tokens, or the market value management risk of the self-built LP pool. After all, not everyone can be a good trader.

Summary

At present, there are mixed comments on NFT in the market, more and more people think that NFT is still a huge bubble, crazy JPEG (picture format) lacks practical value support, and some supporters say it is the “new cultural revolution” of our time.

Objectively speaking, there may indeed be some hype in the current market cycle, but whether there is hype or not, the whole ecology of NFT has indeed injected new blood into the whole market. The birth of GameFi is personally understood as an evolution of DeFi, and the concept of meta-universe does make us see the possibility of the future world. Although NFT collection is considered to be the most frothy market, its application value can not be ignored. Its unique application in the field of IP can perfectly solve the problems in the field of IP copyright in the traditional market, and can provide a free and open platform for more art creators, so that they can speak more freely.

Traditional technology, luxury goods and other industry giants have entered the layout of NFT, but also confirmed the actual value of NFT, in short, existence is reasonable, if you do not understand, then follow in the footsteps of giants, after all, the feeling of stepping into the air is more uncomfortable, but at any time to rational judgment, maintain risk awareness.

These are some of the ideas on investment in NFT collectibles. If there are any inadequacies described in the article, you are welcome to correct them. At the same time, you are welcome to join the Coinhub fan group to communicate:https://t.me/Coinhub_CN

Awsome

ReplyDeleteGzbb

ReplyDelete